Surge Copper – Comprehensive Exploration And Development Milestones From The Copper-Moly-Silver Berg Project

Leif Nilsson, CEO & Director of Surge Copper (TSX.V:SURG – OTCQX:SRGXF), joins us for a comprehensive update on all the news and company milestones, including ongoing exploration and development work at the flagship copper-molybdenum-silver-gold Berg Project in British Columbia. We also spend a little time towards the end on unrecognized value at the secondary Ootsa Project.

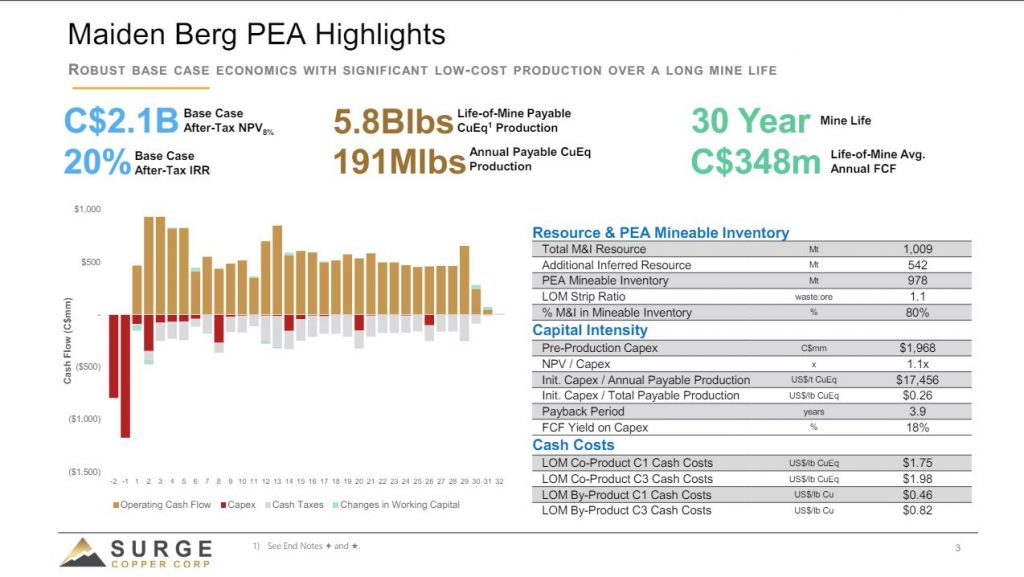

We start off having Leif outline the key economic metrics from the Preliminary Economic Assessment PEA released in June 2023, for a sense of the size and scale of the Project, and how it stacks up to other large copper development assets in Canada.

- Base case after-tax NPV8% of C$2.1 billion and IRR of 20% based on long-term commodity price assumptions of US$4.00/lb copper, US$15.00/lb molybdenum, US$23/oz silver, and US$1,800/oz gold plus foreign exchange of 0.77 USDCAD

- 30-year mine life with total payable production of 5.8 billion pounds (2.6 million tonnes) of copper equivalent (CuEq), including 3.7 billion pounds (1.7 million tonnes) of copper

- Updated mineral resource estimate includes combined Measured & Indicated resource of 1.0 billion tonnes grading 0.23% copper, 0.03% molybdenum, 4.6 g/t silver, and 0.02 g/t gold, containing 5.1 billion pounds of copper, 633 million pounds of molybdenum, 150 million ounces of silver, and 744 thousand ounces of gold, plus an additional 0.5 billion tonnes of material in the Inferred category.

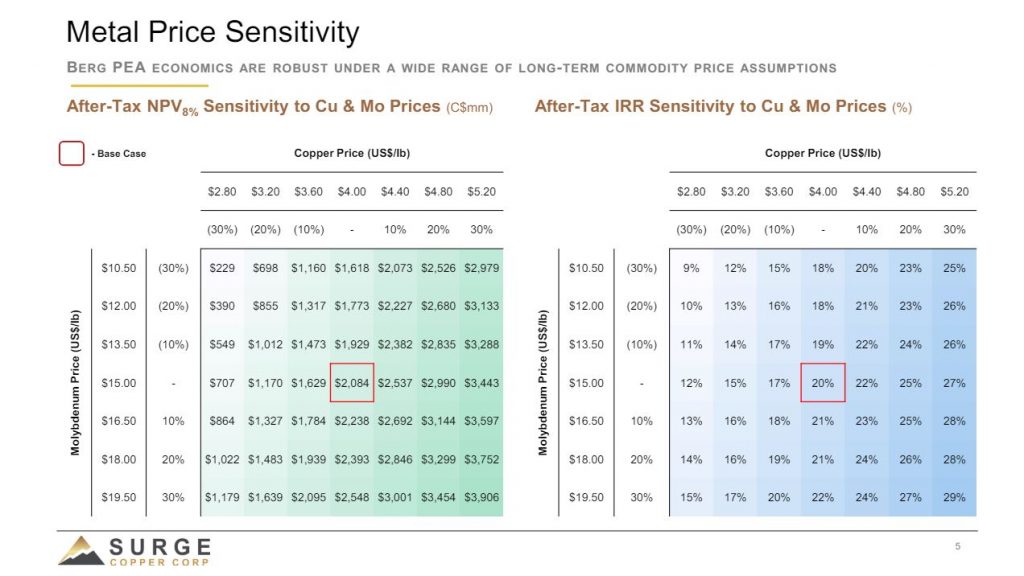

This leads into a discussion on how the project economics would change with sensitivities to current metals prices closer to spot pricing. Leif also spends some time breaking down the conservative method the Company uses for calculating copper equivalent figures, compared to many peer companies in the sector, and why it is a more fair and accurate approach. We also highlight the critical minerals components for the copper and molybdenum mineralization, and how these provide some optionality when looking at raising capital for the development of the project down the road.

With regards to exploration, the 2024 field program completed a total of 10 diamond drill holes for 3,707 meters at the Berg Project, and 2 holes at the Ootsa Project for 897 meters. All 10 holes at the Berg deposit are expected to support resource definition and conversion of Inferred resources to higher confidence categories.

Drilling Highlights released to date:

- Hole BRG24-256 intersected 178 metres grading 0.40% CuEq (0.30% Cu, 0.017% Mo, 7.99 g/t Ag, 0.024 g/t Au) from 10 metres depth

- Hole BRG24-255 intersected 320 metres grading 0.46% CuEq2(0.29% Cu, 0.048% Mo, 4.26 g/t Ag, and 0.024 g/t Au) from 10 metres depth

- Hole BRG24-254 intersected 412 metres grading 0.40% CuEq2(0.24% Cu, 0.042% Mo, 5.4 g/t Ag, and 0.02 g/t Au) from 36 metres depth

- Hole BRG24-253 intersected 288 metres grading 0.30% CuEq (0.23% Cu, 0.013% Mo, 4.49 g/t Ag, 0.03 g/t Au) from 12 metres depth

6 of the Berg deposit holes underwent downhole geotechnical testing, including Packer tests, piezometer installations, and televiewer surveys, supporting pre-feasibility mining studies. Core samples will also undergo geochemical analysis and acid-base accounting test work during the winter, supporting ARD/ML environmental baseline and pre-feasibility studies on waste rock management. An environmental baseline data collection program was initiated across the project area to bolster previously completed database efforts. A pre-feasibility level metallurgy program is ongoing and slated for completion in early 2025, with a Pre-Feasibility Study (PFS) slated for late in 2025, but there has not been a precise date set at this point.

If you have any follow-up questions for Leif regarding Surge Copper, then please email them to me at Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Surge Copper at the time of this recording.

.

Click here to follow along with the latest news from Surge Copper

.

.

Metals are stuck ……

can silver hit $35 close at the end of December….. I doubt it… stuck in a rut….

Three and a half years ago New Found Gold was selling for $13, today it can be bought for $2.50, and you can’t compare what they had then verses now. At one point recently it dropped to $2.29. Doc thinks it might go down even more to $1-$1.5. $13 might be a bargain in the future but I’m betting it will hit $2. DT